Sale of shares in your business can happen for a multitude of reasons; you could want to take on a partner to add their skills into your business, or find outside investors to improve cashflow or to fund growth. In this post we’ll look at the tax implications that this might have and what to watch out for.

The two big tax issues at play are Tax Losses and Imputation Credits. These are like a bank account which is held by the Inland Revenue. You can’t withdraw cash from this account, but you use credits in this account to offset future tax payments.

If you sell a over a certain % of your business these accounts cannot be carried forward and are wiped out.

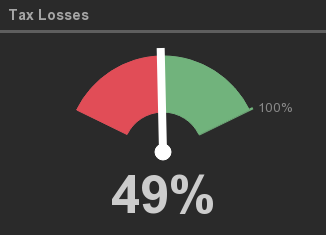

Tax Losses

Losses can accrue in the first few years in business, as companies invest in building a product or service and haven’t seen revenues to match. Losses are carried forward from year to year and then applied in a year when a profit is made. Rather than pay tax on your first year of profit, you can apply prior years losses against the amount, reducing the tax bill.

In order to continue to carry forward losses (and reduce future tax), you must continue to hold 49% of your shareholding through a share sale. This means you can sell up to 51% of your business and retain these losses to carry forward. As soon as you sell 52%, or 51.1% - these losses are essentially wiped. Bad news!

Imputation Credits

New Zealand operates a fun scheme for taxing shareholders. The “Imputation Regime” essentially prevents double taxation for shareholders in companies so when dividends are paid, they have invisible tax credits attached. When your company pays tax on its profits, credits accumulate in the Imputation Credit Account until they are attached to dividends to shareholders.

Your ability to continue to add these tax credits to future dividends becomes impaired if you retain less than 66% of your shareholding in a sale..

Notice how those figures are different?

You’re unlikely to be in both positions at the same time (but it can definitely happen). We recommend talking to your accountant to see which position you are in before finalising any share sale.

If you’re carrying forward losses:

- Any sale of shares of more than 51% of the business will clear your tax losses carried forward

If you’ve got a Imputation Credit Balance

- Any sale of shares of more than 34% of your business will clear your Imputation Credit Account

Watch out for:

I’ve already sold some shares, and am doing another round of investment

An accurate calculation will need to be completed. Once these thresholds are hit, whether over multiple investment rounds, will trigger a clearing of the Losses / Imputation Credit accounts.

Does it matter what valuation I raise, or how much is paid for these shares?

No - it’s all done on % of the company. So whether 90% is sold for $1 or 1% is sold for $9 the principle remains the same.

Does this apply if I’m selling all my shares into a trust?

Talk to us about this before proceeding!

Don’t understand, want more info? Have any queries?

Please post a comment below, or drop us a line