With a plethora of forecasting systems to choose from, it's useful to check in with your finance team to and touch on some key inclusions for SaaS companies. This is because SaaS companies can have slightly different business models and where your forecasting system is really going to need to shine to get the most out of the process

Getting Setup

Make sure its a three-way forecast

Forecasting Cash or Profit only will only tell half the story. You'll want your forecast to be a three way forecast incorporating a cashflow forecast, profit and loss and a balance sheet forecast. This will also make it far easier when reporting actual results against your early forecast.

Try to look Two to Five years out, and do the first year by month

Typically you're going to want to go out at least two years but limiting it around to five years. This will mean you can accurately see the future growth. By including months for your first year you can get to an accurate level of detail for the next phase of executing your plan.

Separate New Zealand & International Activity for GST

It's really important for New Zealand SaaS companies to not forget about paying GST, and to not collect it on all Subscription Revenue. Remember that International Sales will be treated as Zero Rated for GST purposes in your cash flow foreast

Major Components of a SaaS Company Forecast

1. Users / Subscribers

It's simply not good enough to model an increase in revenue just because you plan to be in business, so a 10% increase in revenue month on month will not cut it with investors and business mentors.

Some key questions for this forecasting process are:

- How many subscribers (NZ and International) will you acquire?

- How much will this acquisition cost?

- How often will they "churn"?

- What will their average revenue per user be?

Getting a better forecast of revenue by exploring these metrics will also help with decision making once you start selling to customers.

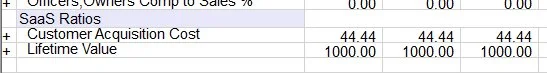

2. Unit Economics

To get a better understanding of your business model, it's a great idea to incorporate unit economics within your forecast to really get your assumptions out there for "testing".

3. Annual vs Monthly Revenue

The chart above shows how cash flow collection is different when collecting annual payments in advance from customers instead of signing them up to a monthly subscription.

Not only can this have a massive impact on cash flow but, putting my Accounting Hat on, GST and Tax. The impact of billing by the year instead of month to month can have the same impact as collecting a big deposit (link) on cash flow.

4. Operating Expenses and Payroll

Knowing these day to day outgoings will help manage your committed spend and get a better idea of your cash burn rates.

Want to take our SaaS template for a spin? Get touch with us here